idaho inheritance tax rate

The IRS provides a few ways to avoid paying capital gains tax on real estate. Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive.

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

The tax rate ranges from 116 to 12 for 2022.

. California has the highest marginal tax rate which combines both. However more-distant family members like cousins get no exemption and pay an initial rate of 15. Idaho state property tax rate.

One way to protect an inheritance received by your children is to create an irrevocable Heirloom Trust. Idaho state sales tax rate. And although the Federal Gift Tax.

Inheritances that fall below these exemption amounts arent subject to the tax. There is no federal inheritance tax but there is a federal estate tax. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. Below are the ranges of inheritance tax rates for each state in 2021 and 2022. A decedents heirs are entitled to inherit her estate according to Idaho statute 15-2-101 when she dies without a will.

The Federal Unified Tax Credit was indexed. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only. Idaho state tax rates Idaho state income tax rate.

Note that historical rates and tax laws may differ. For example lets say a family member passes away in an area with a 5 estate tax. In our current environment the probability is that an Idahoan will not have an estate that is subject to Estate Taxes.

Select Popular Legal Forms Packages of Any Category. Eight states and the District of Columbia are next with a top rate of 16 percent. Idaho residents do not need to worry about a state estate or inheritance tax.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. When the deceased person. Idahos capital gains deduction.

The estate tax rate is based on the value of the decedents entire taxable estate. The tax rate begins at 18 percent on the first 10000 in taxable transfers over the 117 million limit and reaches 40 percent on taxable transfers over 1 million according to an. A strong estate plan starts with life.

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from. However like all other states it has its own inheritance laws including the ones that cover what happens if the decedent dies. For more details on Idaho estate tax requirements for deaths before Jan.

The good news is that it is possible to sell your house in Idaho and avoid paying capital gains tax. In other words the estate itself can be taxed for the amount that is above the exemption cut-off. Idaho has no state inheritance or estate tax.

If the total value of the estate falls below the exemption line then there is no. Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property. Idaho does not have these kinds of taxes.

Inheritance taxes for Idaho residents. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. This trust may allow your child to manage the funds during that.

Technically there are 2 cases when an Idaho resident will become responsible for the tax due when they inherit. This is due to the fact that the assets youve inherited from the deceased person will need to exceed several millions of dollars in order for the estate tax to be levied typically. Section 15-2-102 permits a surviving spouse to inherit the.

Massachusetts has the lowest exemption level at 1 million and DC. All Major Categories Covered. 1 2005 contact us in the Boise area at.

Idaho does not levy an inheritance tax or an estate tax. Call us toll free at 8772326101 or 2082326101 for a consultation with the Racine Olson team. We will answer your questions and will.

Keep in mind that if you inherit property from another state that state may have an estate tax that applies. Inheritance tax usually applies in two cases. Starting in 2023 it will be a 12 fixed rate.

Idaho Health Legal And End Of Life Resources Everplans

Personal Income Tax An Overview Sciencedirect Topics

Are Your Clients Subject To Massive Estate Taxes Without Knowing It Everplans

How Is Tax Liability Calculated Common Tax Questions Answered

Instructions Fiduciary Income Tax Idaho State Tax Commission

Idaho Inheritance Laws What You Should Know

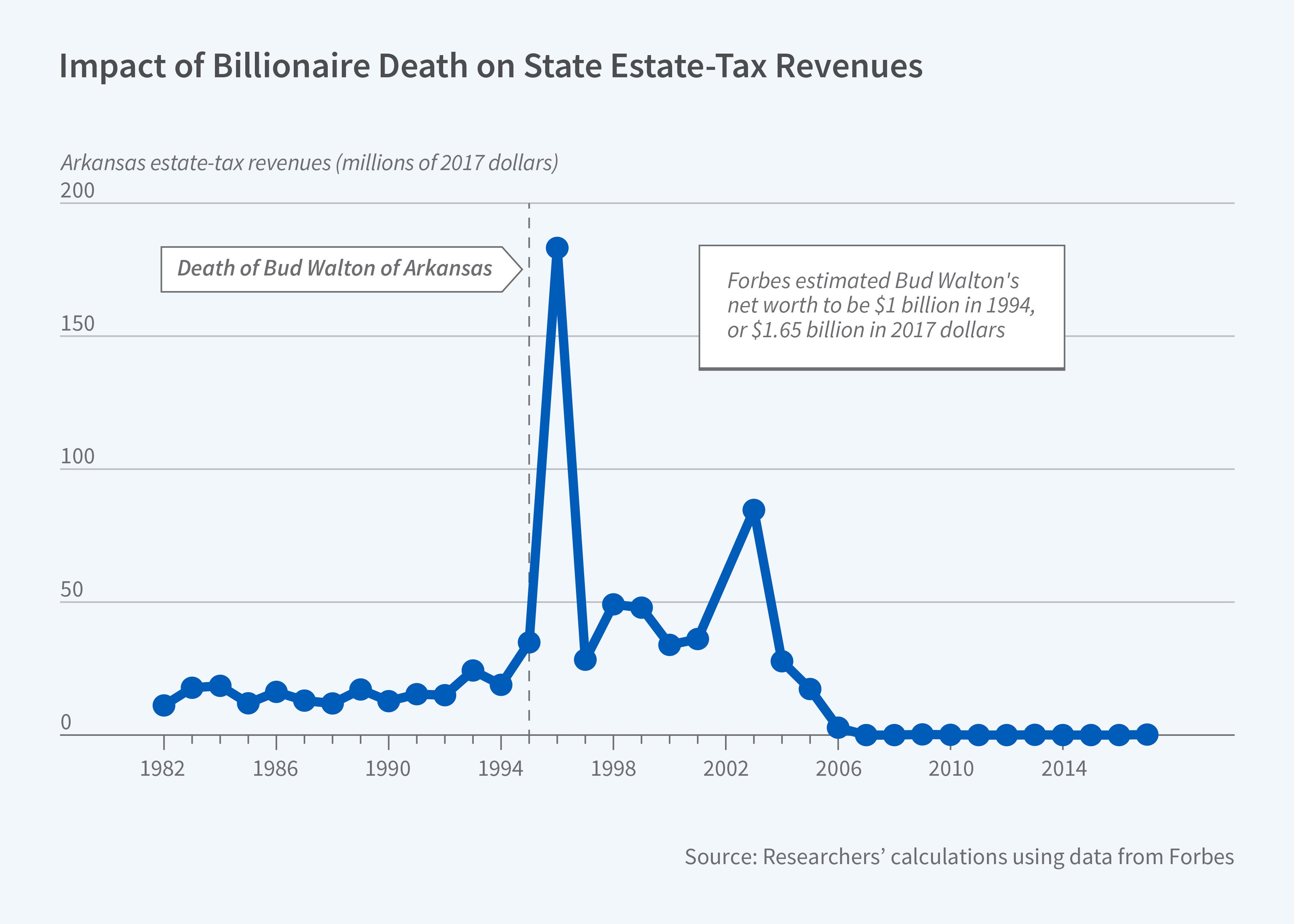

State Level Estate Taxes Spur Some Billionaires To Move Nber

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Is Tax Liability Calculated Common Tax Questions Answered

Historical Idaho Tax Policy Information Ballotpedia

States With Highest And Lowest Sales Tax Rates

Idaho Inheritance Laws What You Should Know

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Idaho Inheritance Laws What You Should Know

Idaho Inheritance Laws What You Should Know

Idaho Income Tax Calculator Smartasset

How Is Tax Liability Calculated Common Tax Questions Answered

4 Things You Need To Know About Inheritance And Estate Taxes